April 2025 — Washington, D.C. — Former President Donald Trump’s 25% tariffs on imported vehicles remain firmly in place, despite recent rollbacks on other trade measures. Now, fresh analyses from top industry and financial experts warn the tariffs could deliver a heavy blow to the automotive sector, slashing vehicle sales by millions and adding over $100 billion in additional costs.

Contents

Auto Industry Braces for a Historic Shakeup

Wall Street firms and mobility analysts are forecasting a massive shift in vehicle pricing and manufacturing strategy in the U.S. as automakers respond to these protectionist policies.

According to Goldman Sachs, the average price of a new vehicle in the U.S. is expected to increase by $2,000 to $4,000 over the next 6 to 12 months. This price jump reflects the cost burden of the tariffs and could drive significant changes in consumer behavior.

“This may well be the most consequential year for the auto industry in history,” said Felix Stellmaszek, Global Automotive Lead at Boston Consulting Group (BCG). “Not just because of immediate cost pressures, but because it’s forcing fundamental change in how and where the industry builds.”

Key Projections:

- Sales Impact: Up to 2 million fewer vehicles sold annually across the U.S. and Canada

- Industry Cost Increases: Between $110 billion and $160 billion annually

- Tariff-Driven Price Hikes: Up to $6,000 per imported vehicle, and $3,600 per U.S.-assembled vehicle due to parts tariffs

- Steel & Aluminum Tariffs: Adding another $300–$500 per vehicle

Which Tariffs Are in Effect?

The current tariff framework includes:

- 25% on all imported vehicles

- 25% on imported auto parts (starting May 3)

- 25% on steel and aluminum

- 145% on Chinese imports

- 25% on vehicles from Canada and Mexico

These sweeping tariffs cover both vehicles and key components, raising production costs for domestic and foreign automakers alike.

Automakers React: Incentives, Supply Holds, and Export Cuts

While some manufacturers have rolled out short-term promotions to blunt the consumer impact, others are scaling back U.S. operations altogether:

- Ford and Stellantis: Offering limited-time employee pricing

- Jaguar Land Rover: Halting U.S. vehicle shipments

- Hyundai: Committed to price freezes for two months to ease buyer concerns

Analysts at Telemetry say most automakers have a two-month buffer supply of vehicles unaffected by the new tariffs. But after that, price hikes are expected to hit showroom floors.

Consumer Pain: Affordability Crisis Deepens

Even before the tariffs, car buyers were facing record-high prices and interest rates. According to Cox Automotive:

- The average new vehicle price is nearing $50,000

- Auto loan rates are hovering around 9.64% for new and nearly 15% for used vehicles

“Higher tariffs will tighten supply, reduce discounting, and drive prices up further,” said Jonathan Smoke, Chief Economist at Cox Automotive. “We expect production cuts, fewer models, and more expensive vehicles across the board.”

Broader Economic Impact Looms

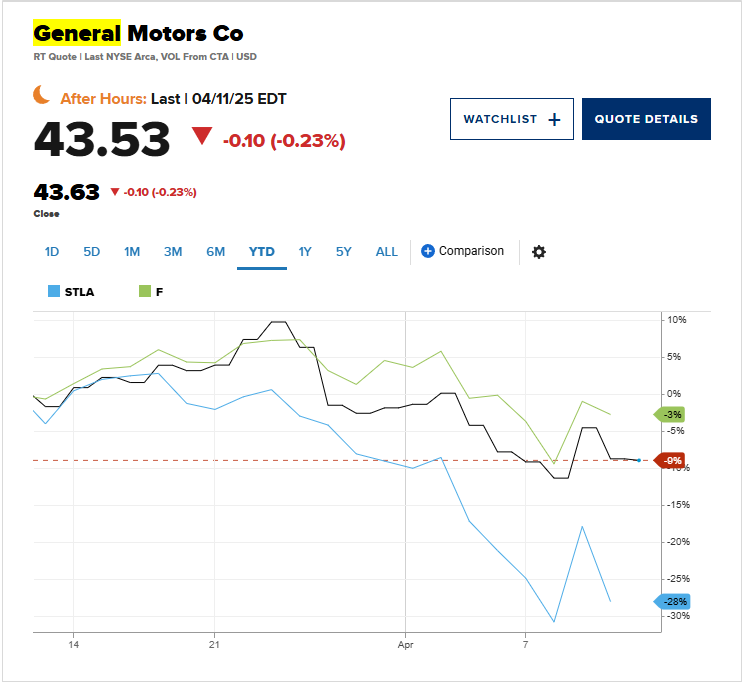

As costs rise and sales fall, ripple effects are expected throughout the economy. The Center for Automotive Research projects a $107.7 billion cost increase for U.S. automakers alone, with Detroit’s Big Three—General Motors, Ford, and Stellantis—collectively absorbing over $41.9 billion of that.

“A couple million-unit reduction in sales will have a broad impact economically,” said Sam Abuelsamid, VP of Insights at Telemetry. “Not just for the auto sector—but for consumer spending overall.”

Bottom Line

The continued enforcement of Trump’s 25% auto tariffs is setting the stage for one of the most disruptive periods in automotive history. With costs rising, vehicle affordability declining, and global supply chains under strain, the industry is being forced to rethink its future—from pricing strategy to manufacturing footprint.

Automotive industry expert and editor of Vhiclo, specializing in car news, EV technology, and in-depth vehicle analysis. With years of experience in the field, Koutaibah provides trusted insights for enthusiasts and professionals alike.