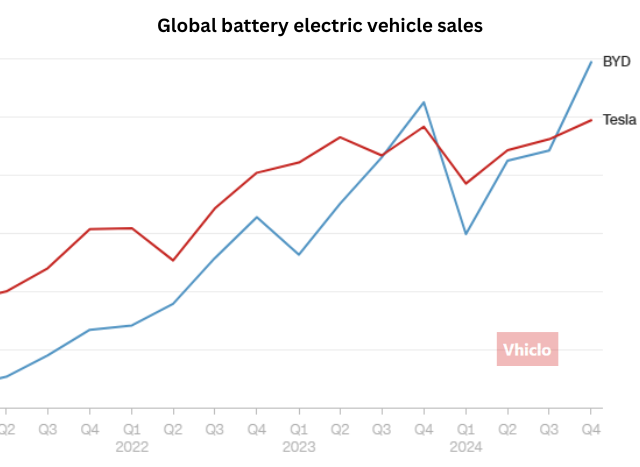

BYD, China’s electric vehicle (EV) powerhouse, has officially overtaken Tesla in annual sales, reporting a staggering 777 billion yuan ($107 billion) in revenue for 2024. This achievement positions BYD’s annual sales at the forefront of the global electric vehicle industry, surpassing Tesla’s reported $97.7 billion in revenue and marking a significant milestone in the ongoing competition between the two clean-energy giants.

- BYD annual sales hit $107 billion in 2024, surpassing Tesla’s $97.7 billion.

- BYD delivered 4.27 million vehicles, compared to Tesla’s 1.79 million.

- BYD now controls 32% of China’s NEV market, while Tesla holds just 6.1%.

- BYD’s innovations include ultra-fast charging and a free advanced driver-assistance system.

- Tesla faces regulatory delays in China and sales declines in Europe.

Contents

- 1 BYD Delivers Over 4.27 Million Vehicles in 2024

- 2 BYD Expands Dominance in China’s EV Market

- 3 CEO Wang Chuanfu: BYD Is Reshaping the Global Auto Market

- 4 BYD Outpaces Tesla with Ultra-Fast Charging and Advanced Tech

- 5 Tesla Faces Regulatory and Market Challenges in China and Europe

- 6 Global Tariffs Limit BYD’s U.S. Expansion—But Not Its Growth

BYD Delivers Over 4.27 Million Vehicles in 2024

In a financial disclosure released on Monday, BYD confirmed a 29% year-over-year increase in total vehicle sales. The company delivered 4.27 million vehicles in 2024, a figure that includes both fully electric vehicles (EVs) and plug-in hybrids.

In contrast, Tesla reported 1.79 million battery electric vehicle deliveries for the year—a 1.1% decline compared to 2023, marking the first year-over-year drop in the company’s delivery numbers.

BYD Expands Dominance in China’s EV Market

BYD’s exceptional growth in 2024 further solidifies its dominance in China’s booming EV market, the largest in the world. According to the China Passenger Car Association, BYD captured a 32% market share of the country’s new energy vehicle (NEV) segment, which includes hybrids and fully electric vehicles. Tesla’s share, by comparison, was just 6.1%, despite strong shipment figures.

BYD’s ascendancy reflects a broader shift in the global automotive landscape, where domestic Chinese EV manufacturers are quickly gaining ground and, in some cases, outperforming traditional Western players.

CEO Wang Chuanfu: BYD Is Reshaping the Global Auto Market

In BYD’s latest annual report, CEO Wang Chuanfu highlighted the company’s “rapid development” and strategic vision. He stated:

“BYD has become an industry leader across multiple sectors—from batteries and electronics to new energy vehicles—breaking the long-standing dominance of foreign brands and reshaping the global market landscape.”

This statement underscores BYD’s ambition to be more than just a domestic leader, as it aggressively expands into international markets and pushes technological boundaries.

BYD Outpaces Tesla with Ultra-Fast Charging and Advanced Tech

One of the key differentiators helping BYD surpass Tesla in both sales and innovation is its relentless investment in EV technologies. Last week, the company unveiled a new ultra-fast charging system that can deliver 250 miles of range in just five minutes, far outperforming Tesla Superchargers, which offer around 200 miles in 15 minutes.

In addition, BYD introduced a proprietary driver-assistance system called “God’s Eye”—offered free of charge with most models. This stands in stark contrast to Tesla’s Full Self-Driving (FSD) system, which comes with a $99 monthly subscription or a one-time $8,000 fee in the U.S.

Tesla Faces Regulatory and Market Challenges in China and Europe

Tesla’s struggles in China, its second-largest market, continue to grow. The much-anticipated launch of FSD in China has been delayed due to regulatory hurdles. A limited trial began last week but was abruptly halted. Tesla’s Chinese customer service later stated that it is actively working with authorities to secure approval.

In a post on Weibo, Tesla stated:

“All relevant parties are actively advancing the process, and once everything is ready, we will roll out the updates as soon as possible.”

Tesla’s global woes don’t stop there. The company also experienced a significant sales decline in Europe, with February sales dropping by approximately 40% year-over-year, according to the European Automobile Manufacturers’ Association. This marks the second consecutive month of falling sales on the continent.

Global Tariffs Limit BYD’s U.S. Expansion—But Not Its Growth

Despite BYD’s dominance in China and rising influence globally, its entry into the U.S. market remains restricted due to high tariffs on Chinese EVs. However, the company continues to grow aggressively in other international markets, including Asia, Europe, and South America.

Meanwhile, Tesla’s dependence on international growth makes its regulatory setbacks and increased competition all the more concerning for investors and analysts monitoring the EV sector.

BYD’s record-breaking 2024 performance marks a pivotal moment in the global EV industry. By surpassing Tesla in both sales and revenue, BYD has positioned itself as a global force to be reckoned with. As the battle for EV dominance intensifies, the BYD vs Tesla rivalry will likely shape the future of electric mobility in the years to come.

Automotive industry expert and editor of Vhiclo, specializing in car news, EV technology, and in-depth vehicle analysis. With years of experience in the field, Koutaibah provides trusted insights for enthusiasts and professionals alike.