Rivian Automotive (NASDAQ: RIVN) stock declined nearly 6% on Wednesday after the electric vehicle maker reported a 36% year-over-year drop in Q1 2025 deliveries, although the figures remained within its previously stated guidance. The company also reaffirmed its full-year delivery outlook, signaling confidence in its long-term growth plans despite near-term headwinds.

Contents

Q1 2025 Delivery and Production Snapshot

- Vehicles Delivered: 8,640 (vs. 13,588 in Q1 2024, down 36%)

- Vehicles Produced: 14,611 at Rivian’s Normal, Illinois plant

- Analyst Delivery Consensus: ~8,930 vehicles (based on 4 analysts, FactSet)

- Company Guidance: ~14,000 vehicles produced; ~8,000 delivered

Although deliveries fell significantly from the prior year, the results met Rivian’s expectations for the quarter. The company’s ability to boost production while keeping deliveries aligned with guidance helped temper some investor concerns.

Rivian Maintains 2025 Outlook

Despite the weak Q1 showing, Rivian reaffirmed its 2025 delivery forecast of 46,000 to 51,000 vehicles, consistent with its prior estimates.

That said, the guidance suggests flat to slightly lower deliveries compared to 51,579 units delivered in 2024. Rivian also maintained its forecasted adjusted net loss of $1.7 billion to $1.9 billion for the year, an improvement from the $2.69 billion loss reported in 2024.

Strategic Shifts: Spinning Off Micromobility

In a strategic move to sharpen its focus, Rivian recently spun off its micromobility division into a standalone entity called Also on March 26. The new venture will develop compact, lightweight vehicles designed for urban and last-mile transportation needs.

Rivian also announced that also secured $105 million in initial funding from Eclipse Ventures, underlining investor interest in alternative mobility solutions outside of traditional EVs.

Looking Ahead: R2 SUV and Gross Profit Milestone

Rivian continues to make strides toward profitability. In Q4 2024, the company reported:

- $170 million in gross profit

- $31,000 in cost savings per vehicle

- Achievement of positive gross profit per vehicle for the first time

CEO RJ Scaringe emphasized the importance of cost efficiency as the company gears up for the launch of its mid-size R2 SUV, scheduled for release in H1 2026.

“Our focus on cost efficiency across the business is critical for the launch of our mass-market product,” Scaringe noted in Rivian’s Q4 earnings call.

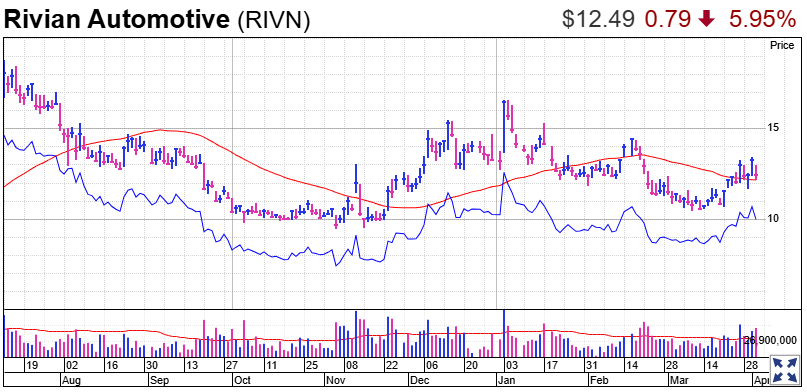

RIVN Stock Performance and Technical Indicators

- Wednesday Close: $12.49 (-5.9%), closing below the 200-day moving average

- 2025 YTD Performance: Nearly flat

- Year-to-Date High: $16.65 on January 3

- 21-Day Average True Range (ATR): 5.81%, indicating high volatility

According to IBD’s MarketSurge tools, Rivian stock remains volatile, with an ATR significantly above the recommended 3% threshold for stable investment candidates. High ATRs indicate larger daily price swings, which can trigger stop-loss rules and challenge investor conviction.

Stock Ratings Snapshot

- Composite Rating: 61 / 99

- Relative Strength Rating: 83

- EPS Rating: 43

- Industry Rank: #5 out of 35 (IBD Auto Manufacturers group)

Despite the delivery miss, Rivian continues to rank competitively within the broader EV sector, supported by its improving margins and clear roadmap to launch new products.

Rivian’s steep Q1 delivery drop raises concerns, but the company’s reaffirmed guidance, operational efficiency gains, and upcoming R2 launch offer reasons for long-term optimism. With volatility still high, investors should closely monitor earnings, delivery trends, and capital strategy as Rivian navigates a pivotal year in the EV space.

Automotive industry expert and editor of Vhiclo, specializing in car news, EV technology, and in-depth vehicle analysis. With years of experience in the field, Koutaibah provides trusted insights for enthusiasts and professionals alike.